When Should You Work with a tax professional?

In general, when it comes to income taxes, most people don’t realise why they will need to employ a qualified professional. The the facts plainly shows that since you don’t have expertise in a particular discipline, the likelihood of being successful are basically imaginary. The legal field is very elaborate, which means that not all people could have to deal with the various circumstances that involve accurate knowledge of the laws and regulations and provisions. It’s factual that whenever you do a specific thing by yourself, it saves you from supplemental expenses, yet it’s far from the truth if you don’t understand what this means to deal with taxes. An unprepared involvement might bring undesirable circumstances. What exactly is seen at first glance may differ so much from reality. This is why, if until now you have been sure that you may handle it all by yourself without having any past experience, it’s the right time to modify your plans. Firstly, you must know that working with a Tax Adviser is not one additional expense. Many people get to fully understand this only following an unsuccessful personal past experience, which you unquestionably do not want.

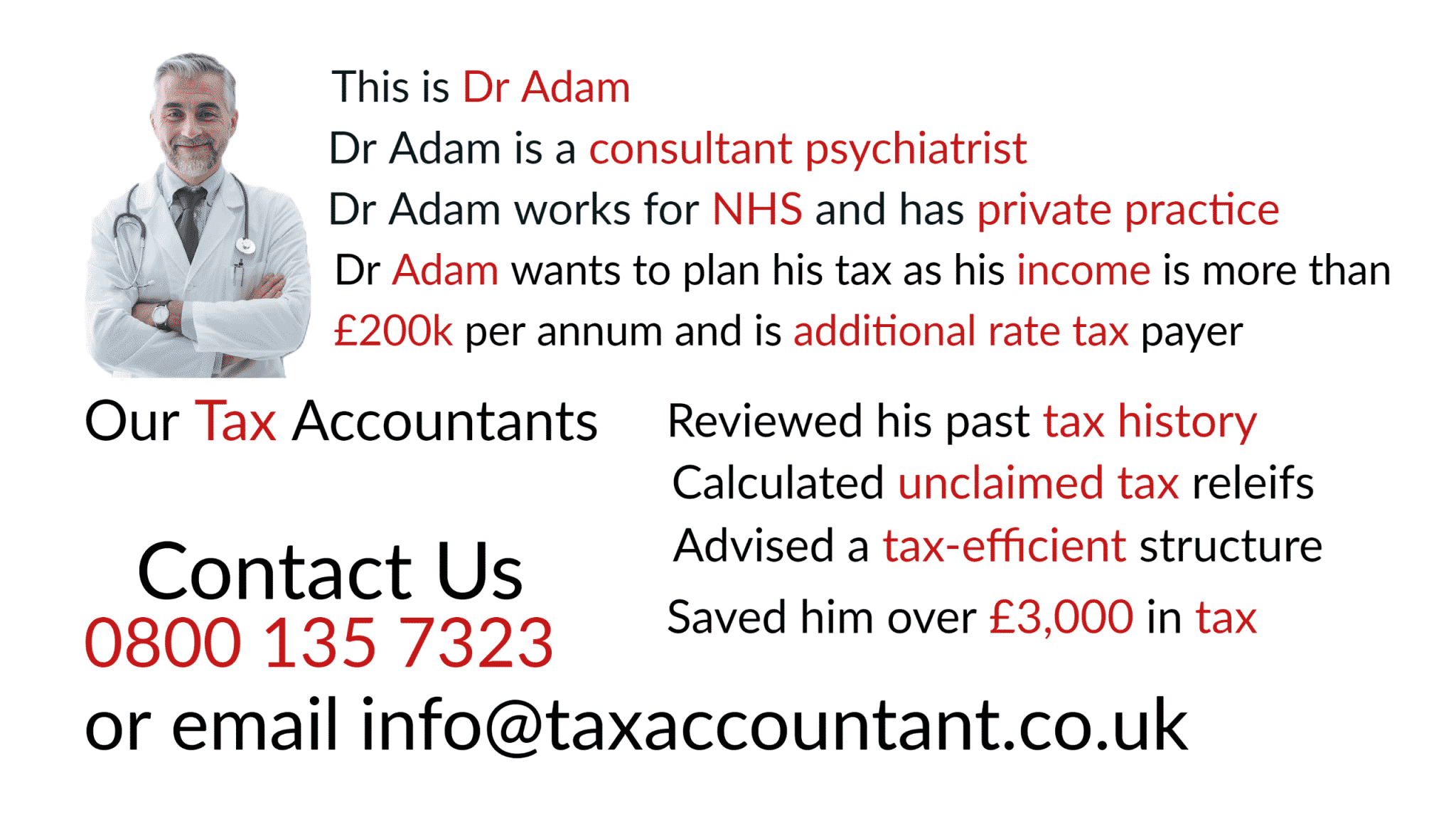

Having and operating a company calls for a lot of effort. So many people are concentrated in the direction of accomplishment, but going through certain stages makes work even more complicated. Here is the case if you take on the role of tax planning without having enough experience. Although the desire to handle certain jobs personally starts out from a noble motive in order to save resources, you may still begin to realize that excessive saving takes you to a different one, certainly unfavorable extreme. Operating a business demands the contribution of some essential people, and tax preparers are some of them. So, since you take into account that taxes are not your area of experience, by far the most decent thing to do is always to look for the assistance of a private Tax Accountant. financial stability is not only about major business enterprise – businesses of any size are targeted. Long term achievements requires a approach but as well as certainty that the money situation is fine. The team, no matter how small it is, if it is composed of the right people, just isn’t possible it will not succeed in the proposed desired goals. Make time to consider the specific situation and this will save you from a lot of unnecessary dangers.

You may check out the search option of Accountant near me or you can check out taxaccountant.co.uk for additional information. What is still essential is the fact that having a tax accountant is a great choice.

For additional information about Accountant near me check out the best resource